- The Unsophisticated Investor

- Posts

- An 80% loss or 1,184% gain... How your investment strategy affects your returns

An 80% loss or 1,184% gain... How your investment strategy affects your returns

Hello friends, and welcome to The Unsophisticated Investor! Brought to you by Scott & Rob, the founders of PitchedIt!

If you want to be one of the first to get access to some of the most exclusive private market investment opportunities in Europe, join our limited waitlist now.

Now, lets get into it 👇

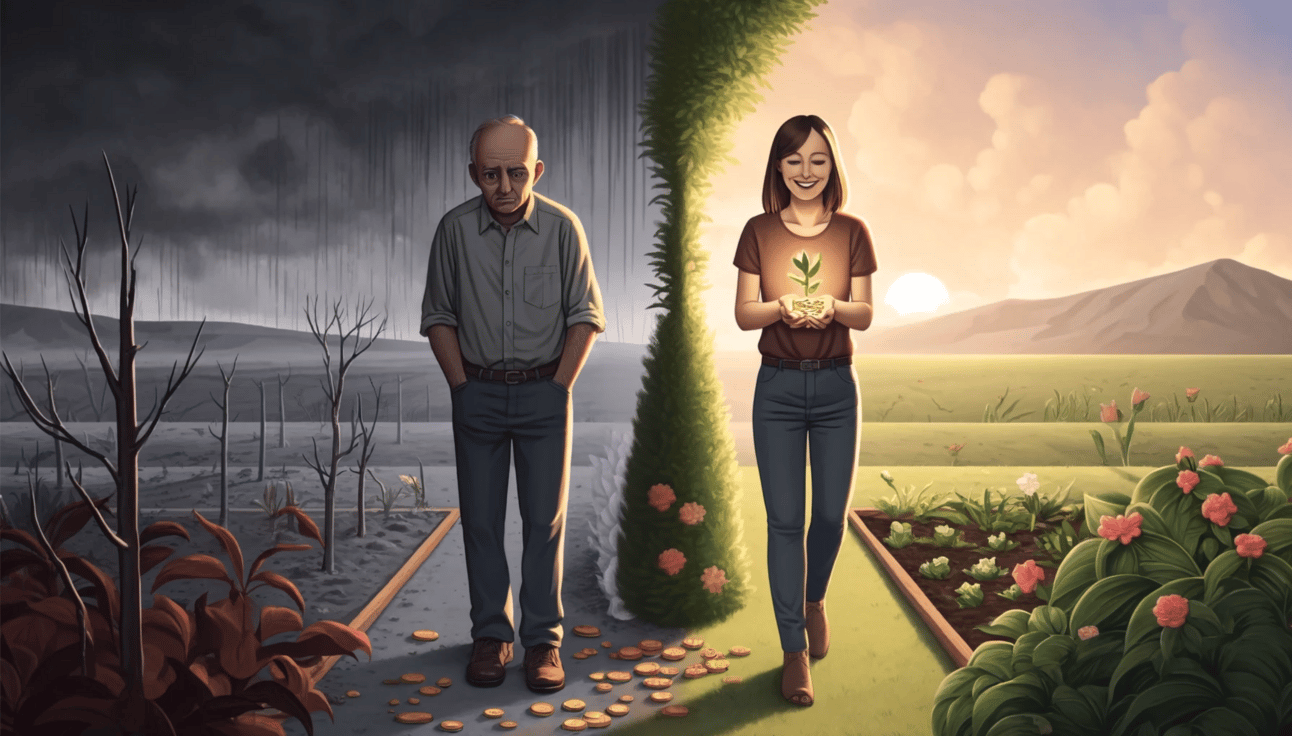

Bob and Amy

So, is diversification really that important in investing, I hear you ask?

To illustrate just how critical it actually is, we’ve put together a simple example of two very different scenarios (we’ve also included a helpful spreadsheet at the end of this post that models each scenario). There are many assumptions here but it’s accurate enough to illustrate the point.

Bob, a novice investor and self proclaimed “day trader” is confident he can beat the market. He’s decided he wants to diversify his portfolio and invest in some private market assets. In this case, startups. He’s decided to risk the odds and go the concentrated route, betting €100,000 between five startups he’s hand picked himself. It's a big gamble but Bob believes it’s going to pay off. The odds are severely stacked against him though as the chances of backing a unicorn (a startup that’s valued at $1 billion or more) are incredibly slim.

Amy on the other hand has taken an entirely different path to diversification and built a highly diversified portfolio of 50 startup investments, putting €2K into each company. Amy isn't too concerned about chasing unicorns, and the ensuing years are far more positive than Bob's. You see, Amy understands that a diversified portfolio not only increases her chances of success, it also heavily mitigates her risk of losing any money at all. According to data published by AngelList, at 50 investments the odds of Amy losing money are less than 5%, compared to Bob at 40%. Wow… 🤯

As you might know, investing in private companies is highly illiquid. But, as long as you’ve chosen your investment strategy wisely, that illiquidity comes with a high premium. When we fast forward 5 - 10 years later, it should be no surprise that Bob’s strategy has definitely not paid off. His original €100,000 investment is now worth a measly €20,000, a painful 80% loss 📉 Now that’s a slow, slow burn… 😩 Amy on the other hand has banked herself an incredible 1,184% gain, turning her original €100,000 into €1,284,000 📈

It should be pretty obvious, but the moral of the story is this: If you're trying to build long term wealth, don’t be like Bob, be like Amy. Diversify, diversify, diversify! Historically though, achieving this level of diversification has been all but impossible for normal people. On top of a heavily connected network, investing in private market assets requires enormous amounts of time, knowledge and capital; not to mention all the regulatory barriers!

Don't worry though, we’re working tirelessly to solve these problems for you, and we’re now closer than ever before. Stay tuned for some very exciting announcements, coming soon 🤫

Thank you to Weekend Fund for sharing their fund model template. You can find the original model in their article here.

Paddy Cosgrave returns as Web Summit CEOAfter resigning over Israel/Gaza controversy, Paddy Cosgrave is back as CEO. He emphasises a shift towards smaller, more intimate events. | The Democratisation of Private EquityA new horizon for retail investors and the recent shifts shaping this future. |

The Unsophisticated Investor is brought to you by Scott & Rob, the founders of PitchedIt. We were both sick of private markets being a playground exclusive to the ultra-wealthy. So… we started a company to challenge the status-quo. PitchedIt’s singular focus is to unlock private markets for Millennial and Gen Z retail investors and help them build wealth through the highest performing private market opportunities.

Scott & Rob

PitchedIt Co-Founders