- The Unsophisticated Investor

- Posts

- Public equities heading for a bumpy ride?

Public equities heading for a bumpy ride?

Today we launched our brand new website and we’re extremely excited! Check it out below and let us know what you think 😁

Now, let’s get into it 👇

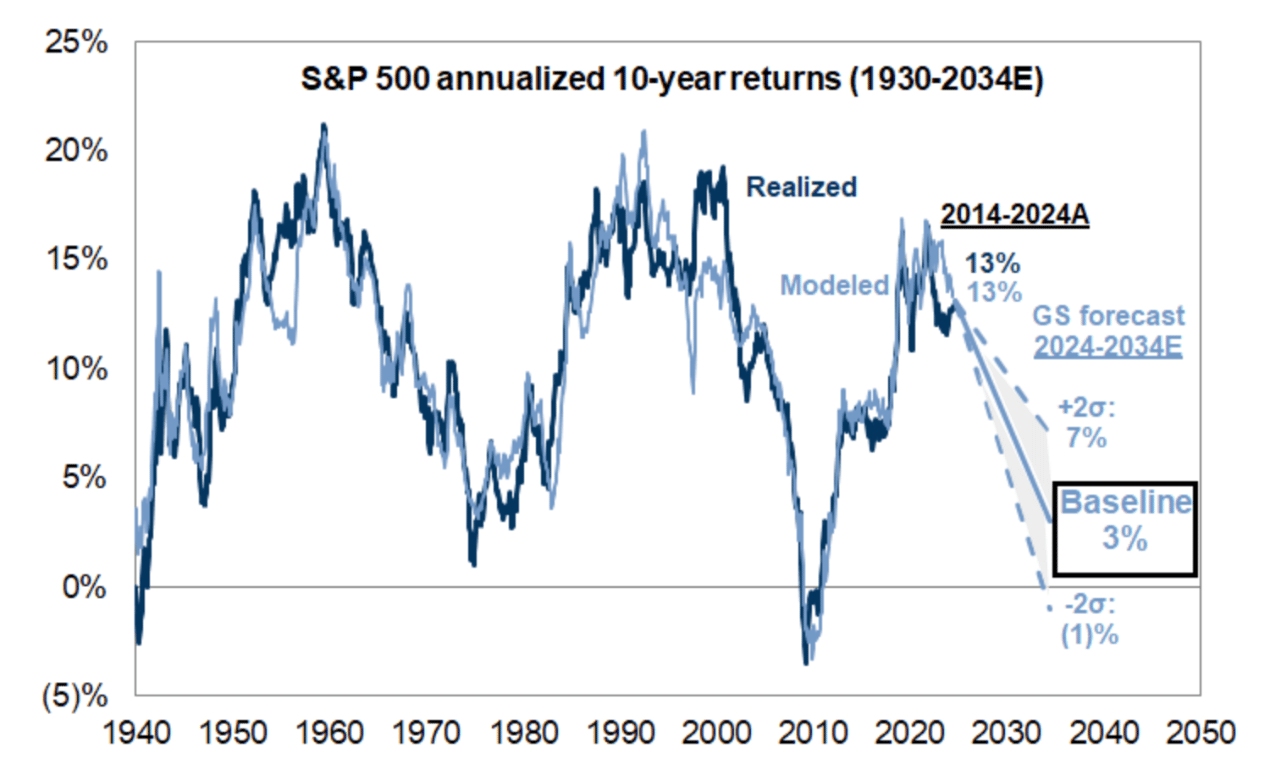

Hey folks, this week we’ll be touching on a report recently published by Goldman Sachs, highlighting a potentially bleak outlook for the S&P 500. The report is leaving many retail investors feeling uneasy about the stock market's future performance, predicting a mere 3% annualised return for the S&P 500 over the next decade. The news probably has many investors asking: is it time to rethink where I put my money?

Over the last ten years, the S&P 500 has enjoyed a very, very impressive annualised return of around 13%. But… Goldman Sachs warns that we might not see those kinds of returns for much longer, emphasising that the current S&P 500 cyclically adjusted price-to-earnings (CAPE) ratio stands at a staggering 38x, ranking in the 97th percentile since 1930. Such high valuations typically correlate with lower future returns. What this suggests is that a correction may be imminent.

What private markets can offer is a return profile uncorrelated to the volatility of public markets, ultimately de-risking your exposure to that imminent correction. Venture capital as an asset class has historically shown strong resilience compared to public equities, as well as the potential for higher returns. Historically, VC funds have delivered, albeit not the most accurate metric, internal rates of return (IRR) between 15% and 25%, depending on various factors like market conditions and the specific vintage year of the fund (a year in which the fund was actively investing in startups). This outperformance stems from VCs ability to identify and invest in high-growth startups early, capturing significant value before these companies go public. And with more companies choosing to stay private longer than ever before, this is an important point. The vast majority of a company's value creation now happens while the company is private, not leaving much upside for post-IPO retail investors.

There are several factors that contribute to the changing return profiles of traditional equities:

Market concentration: The top stocks in the S&P 500 are driving most of its returns. As these companies face challenges maintaining their growth, overall index performance may decline. Again, the pareto principle we spoke about in a previous article in full effect.

Interest rates: With current ten-year US Treasury yields hovering around 4%, bonds are starting to become a more attractive option than stocks. Goldman Sachs estimates a 72% chance that equities will underperform bonds over the next decade!

Economic conditions: The frequency of economic contractions also plays a crucial role in shaping future returns. The Sachs report suggests that elevated market concentration can cause bigger downturns, equating to poor equity performance.

Given these trends, VC might present a more appealing risk-return profile compared to previous years. By investing in innovative startups, you can tap into growth potential that isn’t as closely tied to public market fluctuations.

I know we like to harp on about this, but we’ll say it again: putting all your eggs in one basket probably isn’t a good idea. It’s all about building a well diversified portfolio across multiple asset classes. This is how we protect ourselves against market volatility or any other unfavourable macroeconomic events.

Dedicating a percentage of your portfolio to venture capital will allow you to invest in cutting-edge technologies that have the potential to disrupt entire industries, can help cushion against public market volatility, enhance overall portfolio stability, and offer long-term growth potential. Not to mention the potential for achieving outsized returns that can far exceed any other asset class, be it public or private.

As we look toward the next decade, many retail investors will likely be adapting their strategies in response to shifting market conditions. Considering alternatives like venture capital can position your portfolio for potentially higher returns while reducing reliance on, what is shaping up to be, increasingly risky public equities. Don’t be afraid to explore new avenues in your investment journey. If venture capital is an alternative you adopt to navigate an uncertain future while in search of better returns, Shuttle is here to help!

What we’ve been working on at Shuttle

The only update worth mentioning today is that we’ve LAUNCHED OUR NEW SITE 🤩😍

Microsoft and a16z set aside differences in plea against AI regulationTwo of the biggest forces in tech join hands | US-focused AI fintech Cleo hits $150m ARRReturn to the UK now on the cards! |

The Unsophisticated Investor is brought to you by Scott & Rob, the founders of Shuttle. We’re both sick of private markets being a playground exclusive to the ultra-wealthy so we started a company to challenge the status-quo. Shuttle’s singular focus is to unlock private markets for Millennial and Gen Z retail investors and help them build wealth through the highest performing private market opportunities.

Scott & Rob

Shuttle Co-Founders